are political contributions tax deductible in oregon

It is not deductible for Federal. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost.

Are Political Contributions Tax Deductible H R Block

Jim will be able to claim a credit of 50 on his 2012 income tax return.

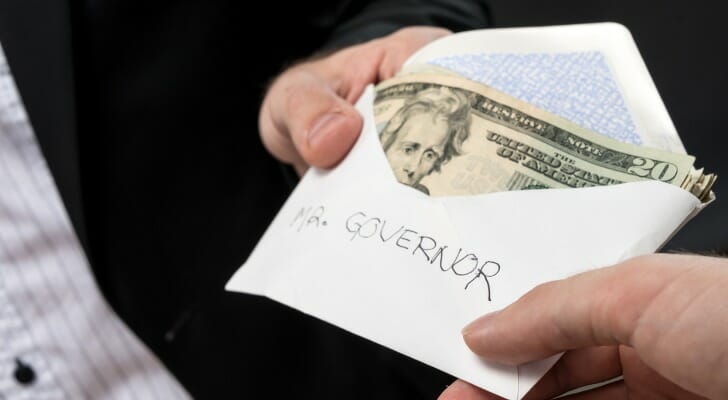

. The following chart shows more details on the FEC campaign contribution limits for. Gambling losses claimed as itemized deduction 604 Federal estate tax 605 Federal mortgage interest credit 607 Federal tax credits 609 Child Care Fund contribution 642 Oregon Production Investment Fund contributions 644 University Venture Development Fund contributions 646 Oregon IDA Initiative Fund donation credit add-back 648. Political contributions as credit against Oregon tax return 1974 Vol 37 p 159 260005 to 260255.

This screen will be seen after the Adjustments Summary screen. Consult your tax advisor for more information. If the state owes you a refund they will add it to your refund check.

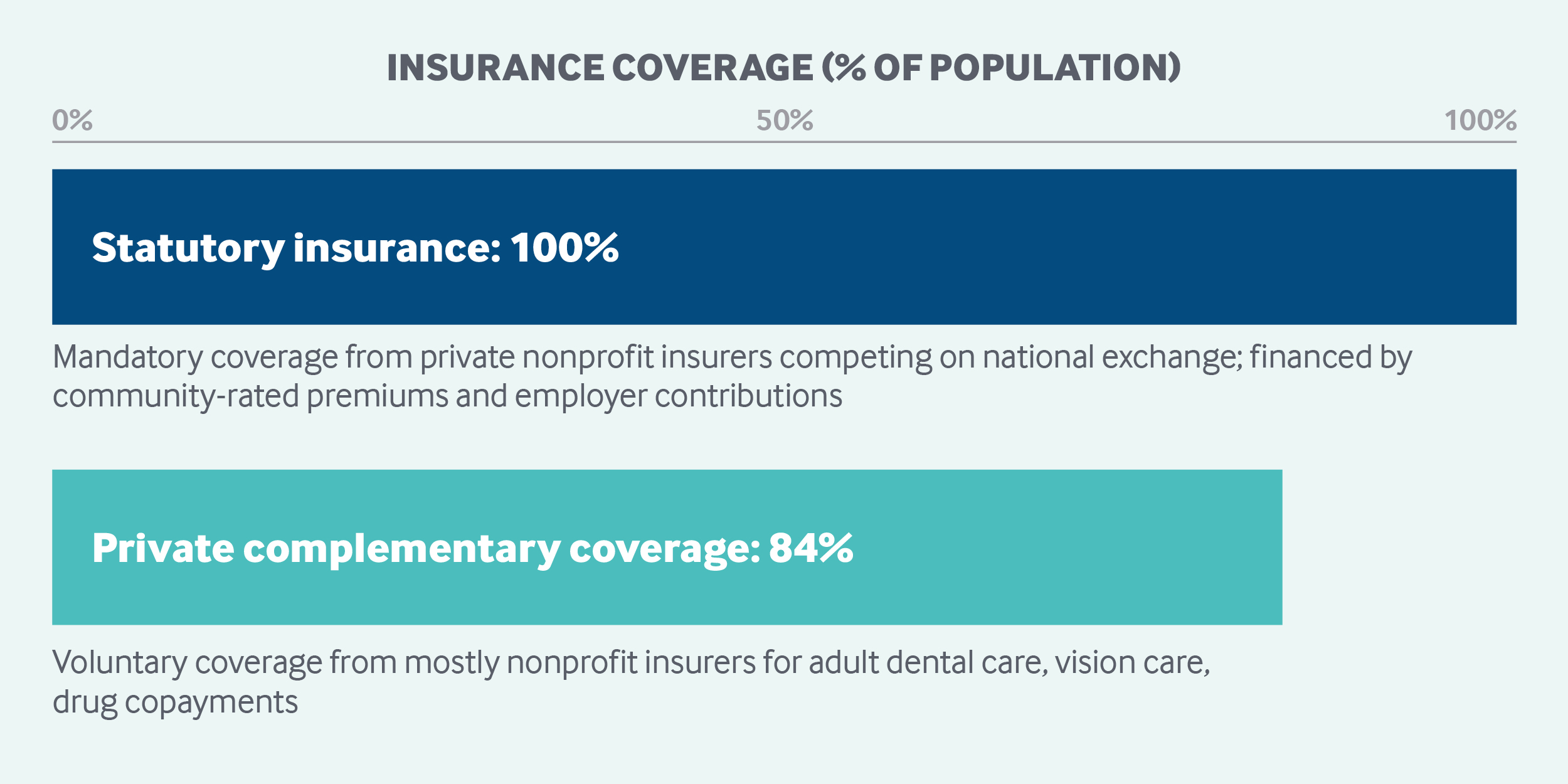

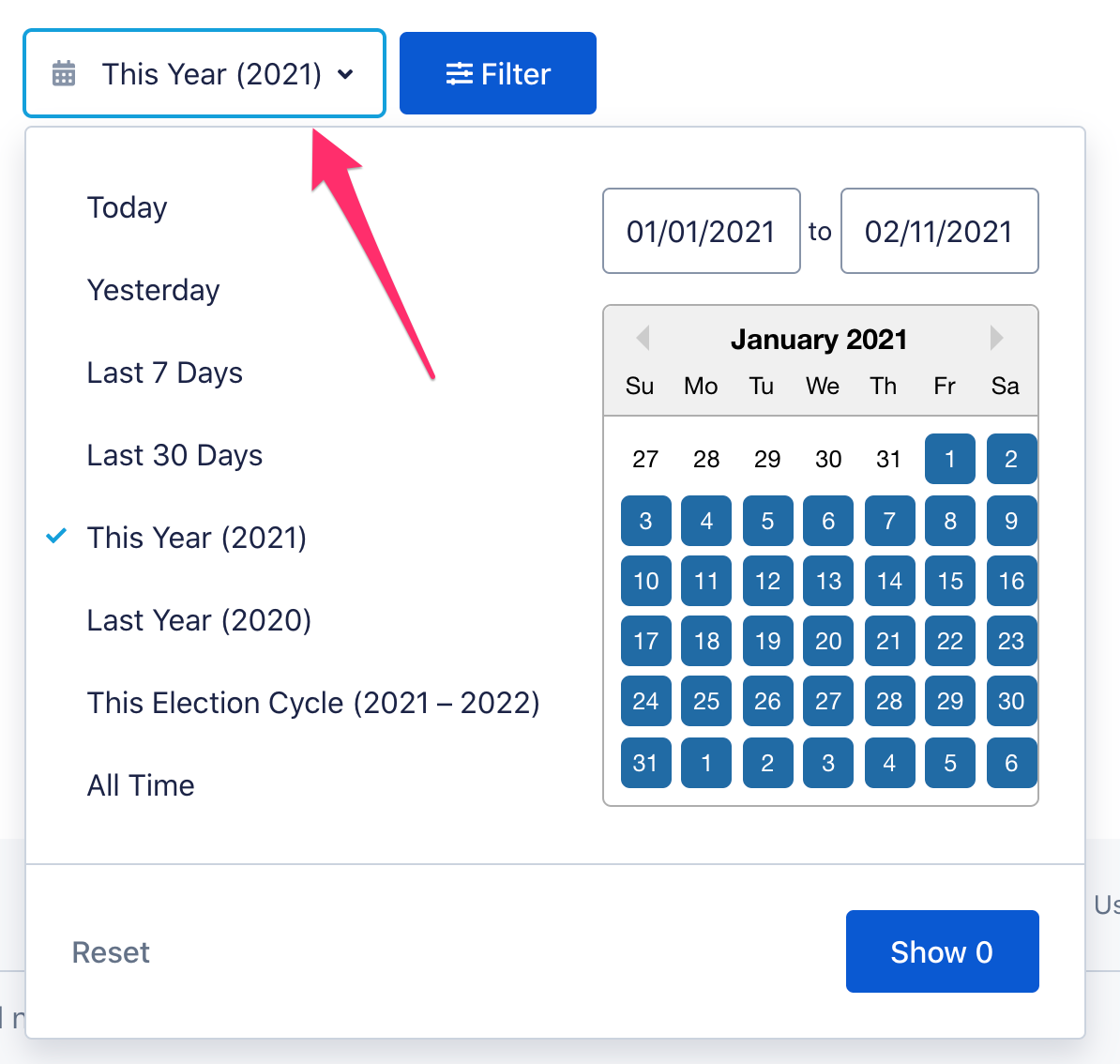

Beginning January 1 2014 there is an income limitation for the Oregon Political Tax Credit. E A proposition or question. Are Political Donations Tax Deductible.

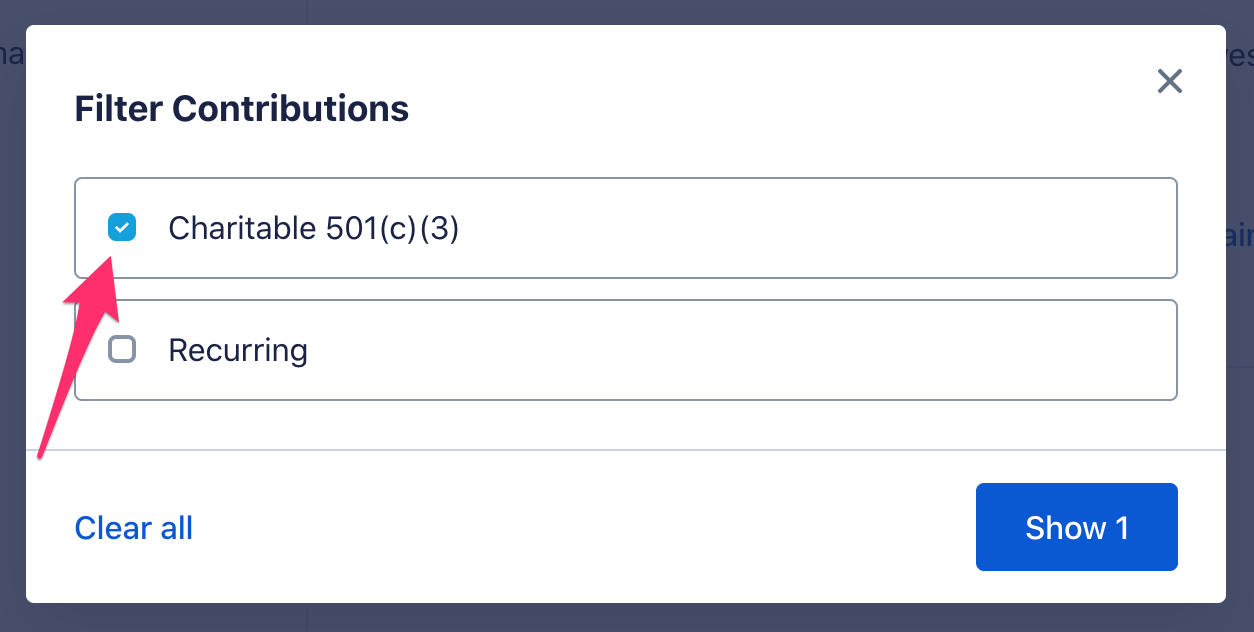

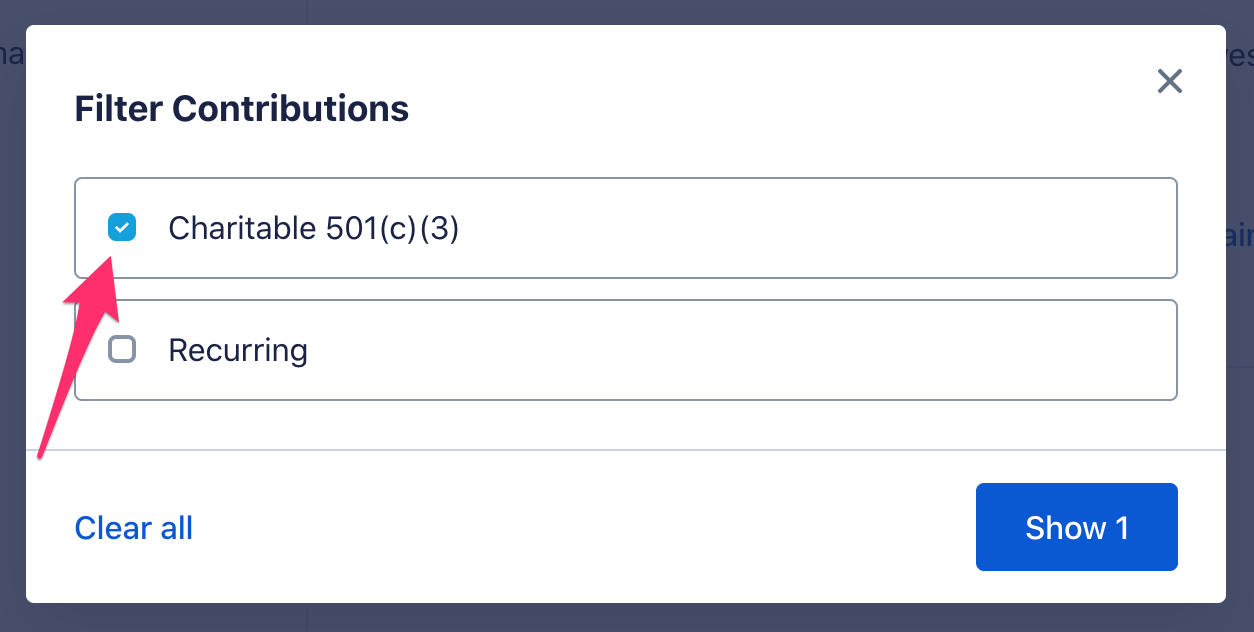

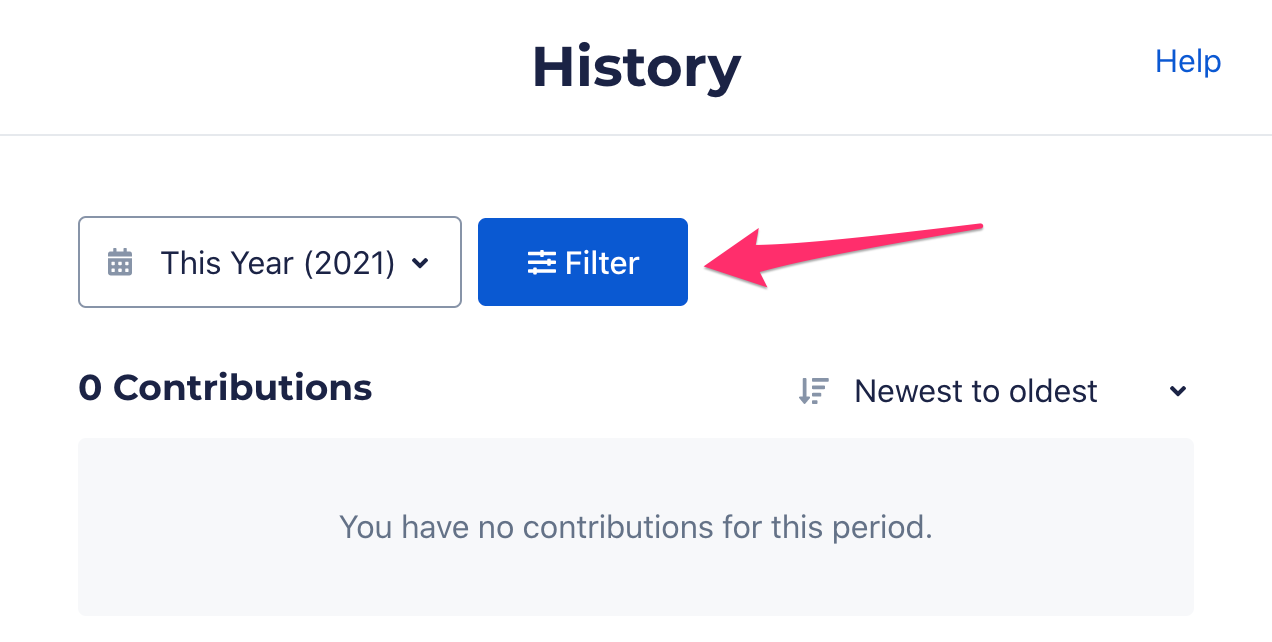

When you are in the State Taxes section for Oregon there is a screen titled Political Contribution Credit where you are able to enter the amount of your Oregon political contributions you are referring to. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. Oregon allows you to subtract donations to political groups or campaigns from your state taxes - up to 50 for individuals or 100 for couples filing jointly.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Expenditures by independent nonpartisan group 1974 Vol 36 p 915. June 4 2019 654 PM.

If you owe taxes you can subtract your contribution from what you owe. The credit is eliminated for contributors with federal adjusted gross income of over 200000 for a joint tax return and 100000 for other individual tax returns. While no state lets you deduct political contributions four of themArkansas Ohio Oregon and Virginiaactually do something better.

Montana offers a tax deduction. Political Contribution Credit Oregon law allows a tax credit for political contributions. Please note that current Oregon law allows individuals with an adjusted gross income of less than 75000 or joint filers with a combined income of less than 150000 to claim the Political Tax Credit.

The amount an individual can contribute to a candidate for each election was increased to 2800 per election up from 2700. Political contributions deductible status is a myth. All contributions qualify for the political 15 contribution credit.

A revision of or amendment to the Oregon Constitution. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Oregon Family Council PAC gifts are not a charitable deduction for income tax purposes.

If you file an Oregon tax return you may be eligible for the Oregon Political Tax Credit which allows you to make a contribution of up to 100 married filing jointly 50 individual filers to our People Not Politicians Committee and receive every dollar of it back when you file your income tax return next year. Qualifying contributions are those made directly to the candidate or the. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Since each primary and the general election count as separate elections individuals may give 5600 per candidate per cycle. Oregon State Political Contribution Credit rcsroper Although you can enter the contribution in TurboTax even if your income is over 150000 it will be flagged when the mandatory review is done before you file your tax return and you will need to. To qualify you must have contributed money in the tax year you claim the credit.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. D Local special or municipal legislation. 17 3 Contributions to candidates.

If he files a 16 joint return with his wifespouse they may claim a 100 credit. Political Contributions as Public Relations or Advertising Expenses. Political contributions are not deductible on your federal return but they are deductible in Montana and can lead to a tax credit in Arkansas Ohio and Oregon.

This is not a deduction. They offer a tax credit for part or all of your contribution up to a certain amount. As of 2020 four states have provisions for dealing with political contributions.

You may not claim this credit if your federal adjusted gross income exceeds 150000 on a jointly filed return or 75000 on all other returns.

Are Political Contributions Tax Deductible Smartasset

Why Political Contributions Are Not Tax Deductible

Money S Power In Politics Give Everyone A Share Cnn

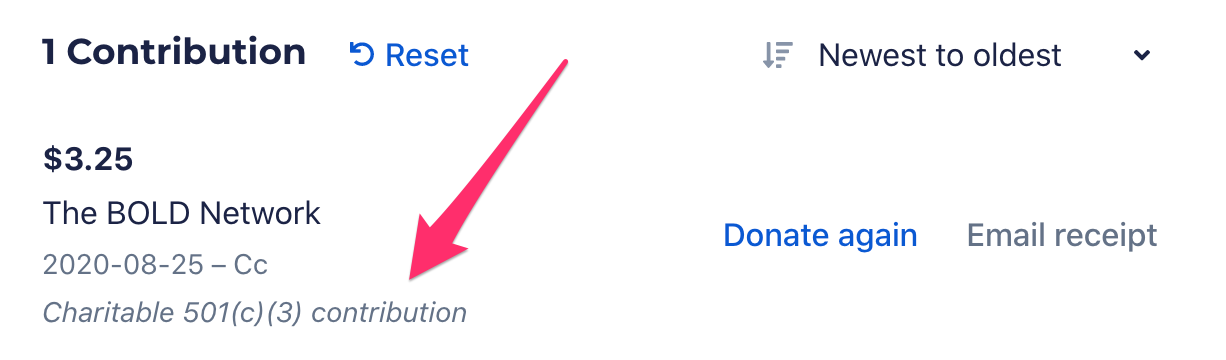

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Smartasset

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible H R Block

States With Tax Credits For Political Campaign Contributions Money